ON THE VALIDITY OF COMPULSORY EQUITY TRANSFER CLAUSE IN CORPORATE GOVERNANCE

Sheng Xuejun & Qian Jin

TABLE OF CONTENTS

I. INTRODUCTION

II. AN EMPIRICAL ANALYSIS OF THE CURRENT PATH OF JUDICIAL REVIEW

A. Case Review

B. Analysis of the Guiding Judgments of Provincial High People’s Courts

III. THE VALIDITY OF THE COMPULSORY EQUITY TRANSFER CLAUSE IN THE ARTICLES OF ASSOCIATION OF LIMITED LIABILITY COMPANY

IV. THE ESTABLISHMENT OF STANDARD OF REVIEW

A. Legitimacy of Effective Conditions of the Compulsory Equity Transfer Clause

B. Legitimacy of Price Clause of the Compulsory Equity Transfer

V. CONCLUSION

Paragraph 4 of article 71 of the Company Law endows the articles of association of the limited liability company with the freedom to create autonomous equity transfer clauses, which results in the dispute over the determination of the validity of compulsory share transfer clauses in the articles of association and their amendments. At present, there is no consensus between the theoretical and practical circles. In principle, the autonomy of a limited liability company based on majority rule should be respected by the court. However, the validity of articles of association in specific situations still needs to be weighed in complex interests. Compulsory equity transfer clause must have the legitimacy, otherwise it may violate fairness and justice and general social emotion. The legitimacy of compulsory equity transfer clause can be materialized and categorized through effective conditions and transfer price. It is not appropriate to regard the prior consent of the expelled shareholder as the sole criterion for affirming the validity of the compulsory equity transfer clause, or to ignore it completely. Instead, it should be regarded as a supplementary element of legitimacy.

I. INTRODUCTION

With the continuous development, reform and improvement of the socialist market economy with Chinese characteristics, modern corporate governance is also constantly innovating and optimizing. The previous practice of copying the Company Law to the articles of association has been increasingly unable to meet the needs of the practice. The Company Law of China of 2005 embodies the liberal legal philosophy on the whole and strengthens the shareholder autonomy and company autonomy in many aspects. Allowing the articles of association to ‘exclude’ the provisions of the Company Law makes a fundamental change in the rules of the Company Law. The first three paragraphs of article 71 of the Company Law contain the basic provisions on the equity transfer of limited liability companies, while paragraph 4 establishes the precedence of the articles of association over the Company Law, allowing shareholders to create autonomous norms that do not conflict with the peremptory norms and the basic principles of the Company Law through the articles of association, that is, ‘where there are other provisions on equity transfer in the articles of association, such provisions shall prevail.’

The articles of association can be divided into the initial articles of association and the amendments to the articles of association. Due to the differences between the initial articles of association and the amendments to the articles of association in many ways, such as the way in which they are generated and the legitimacy of excluding the norms of the Company Law, many scholars tend to treat them differently. As to the validity of the compulsory equity transfer clause set in the initial articles of association and its amendments, there is no consensus in the academic circle at present, and there are still differences in the path of demonstration and conclusion. In the No. 96 Guiding Case issued by the Supreme People’s Court in 2018, Song Wenjun v. Xi’an Dahua Co., Ltd. (dispute over recognition of the shareholder qualification), the court affirmed the effect of establishing compulsory equity transfer clause in the initial articles of association. Firstly, the court held that the initial articles of association were established with the unanimous consent of the shareholders; secondly, based on the characteristics of limited liability companies including closure and union of persons, some restrictive provisions on equity transfer should be respected. However, in the guiding case, the Supreme People’s Court listed a number of reasons and conditions, so when these reasons and conditions are partially met, there are still questions about how to deal with them; at the same time, the problem of the validity of the compulsory equity transfer clause in the amendment to the articles of association has not been clarified.

From the empirical perspective, this paper combs the cases and the guiding judgments of the provincial high people’s courts, explores and analyzes the current path of judicial review; re-combs the relationship between capital majority rule and contract theory from the perspective of legal theory; at the same time, it measures the interests of the limited liability company in combination with the elements such as integrity, autonomy and efficiency, shareholders’ will, inherent rights and so on, conducts typed empirical study on the equity transfer clause, and attempts to refine the path of judicial review from two aspects: equity transfer conditions and transfer price.

II. AN EMPIRICAL ANALYSIS OF THE CURRENT PATH OF JUDICIAL REVIEW

A. Case Review

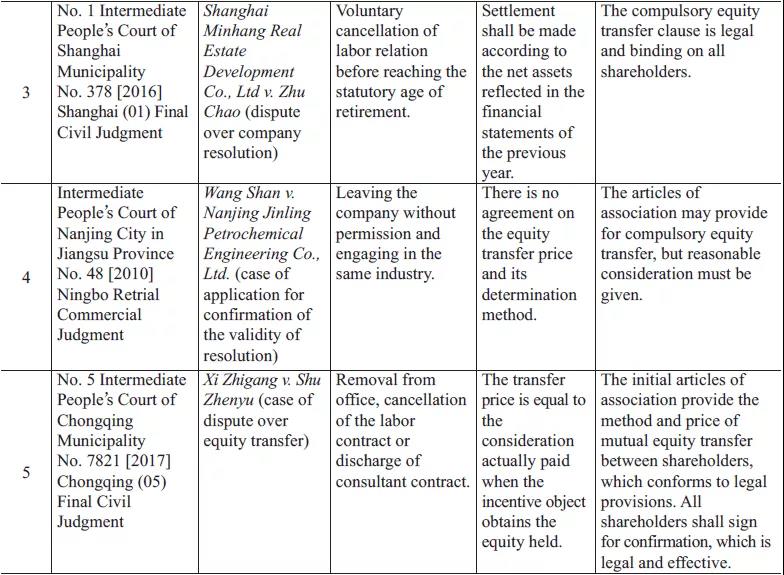

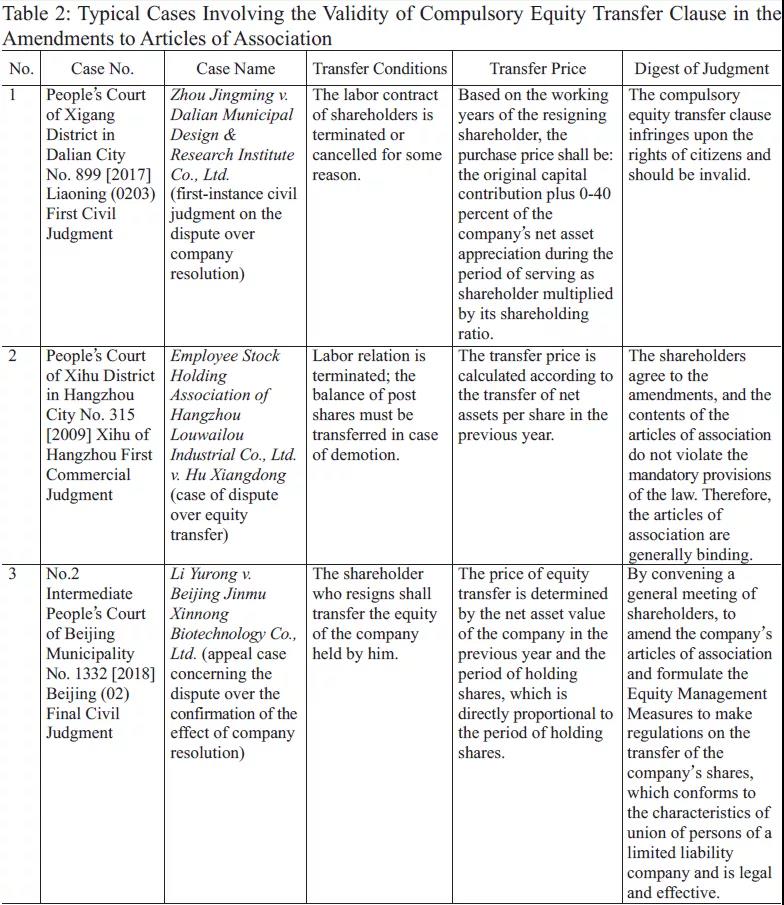

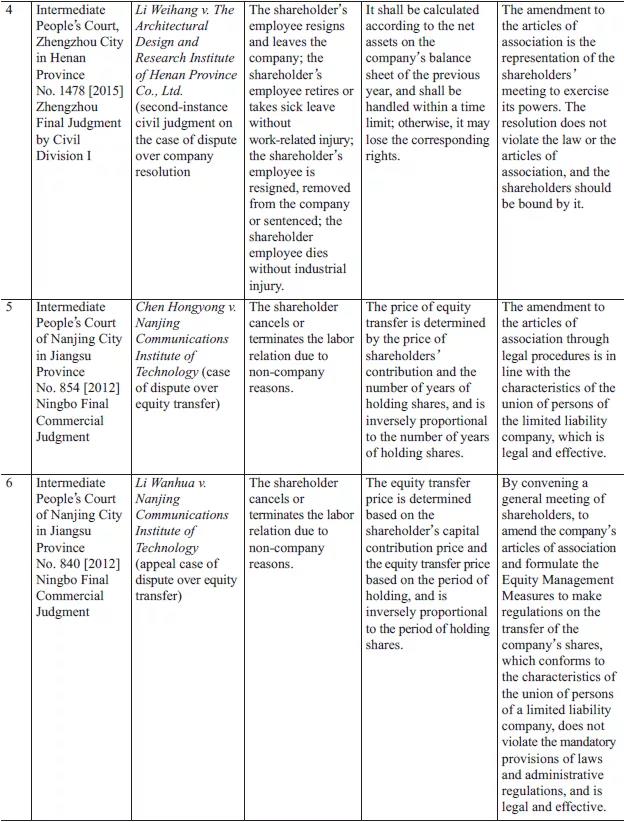

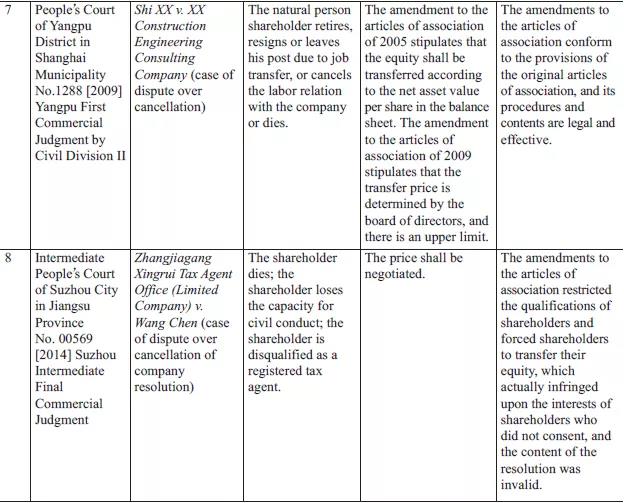

The author searches cases involving the validity of compulsory equity transfer clause in the initial articles of association and its amendments on the network platforms such as the official websites of Pkulaw and China Judgments Online, and searches the keywords of ‘articles of association’, ‘amendments to the articles of association’ and ‘compulsory equity transfer’, and sorts out all of the judgments from 2009 to 2019, and thus have Tables 1 and 2. The former is related to cases involving the initial articles of association, and the latter is related to the cases involving the amendments to the articles of association.

In cases where the record carrier of the compulsory equity transfer clause is the initial articles of association, the court affirmed the validity of the compulsory equity transfer clause in the initial articles of association. On the one hand, the compulsory equity transfer clause in the company’s initial articles of association reflects the common will of all shareholders; on the other hand, the provision of compulsory equity transfer clause in the initial articles of association does not violate the mandatory provisions of any laws and administrative regulations. This kind of judgment focuses on the consent of the expelled shareholders, embodies the principle of good faith of estoppel, and follows the interpretation path of contract theory. In the above-mentioned cases, some courts specifically mentioned in the judgments that if the amendments to the articles of association formulated by the company in accordance with the legal procedures only bind the consenting shareholders but not the dissenting shareholders, it violates the principle of equality of shareholders on the one hand, and it does not conform to the principle of capital majority rule of the Company Law on the other hand.

In addition to the provisions on compulsory equity transfer clause, the articles of association in some cases also refine the relevant matters of compulsory transfer of equity, such as stipulating that the transfer price should be settled with shareholders according to the proportion of net assets reflected in the company’s financial statements of the previous year. As for the compulsory equity transfer clause which does not stipulate the price of equity transfer or the determination method, the court clearly states that shareholders still have the bargaining power for all their shares, and the transfer price should be fair and reasonable.

In the case that the record carrier of the compulsory equity transfer clause is the amendments to the articles of association, the judgments of the courts are not completely unified. Some judgments recognize its validity, while others deny its validity. In the judgment that recognizes the validity of the compulsory equity transfer clause in the amendments to the articles of association, the courts often demonstrate from two aspects: on the one hand, the compulsory equity transfer clause is stipulated based on the capital majority rule in the amendments to the articles of association, which does not violate any prohibitive laws; on the other hand, the company makes special provisions on the equity transfer, which conforms to the characteristics of the union of persons of the limited liability company, and therefore, it is necessarily binding to all shareholders. In the judgments that deny the validity of the compulsory equity transfer clause in the amendments to the articles of association, the judges tend to think that the compulsory equity transfer clause involves the most basic rights of shareholders. Such restriction or deprivation cannot be implemented by the capital majority rule, but must reflect the common will of all shareholders, otherwise it is invalid.

Among the cases mentioned earlier, only in the case of a company resolution dispute between Xingrui Tax Agent Co., Ltd. and Wang Chen, the court has conducted a reasonable review and analysis of the effective conditions of compulsory equity transfer clause. However, most courts did not make further analysis on the types and price terms of compulsory equity transfer clause. They simply applied the analytical framework of the theory of corporate contract or the theory of capital majority rule. This kind of judgment is simple and straightforward, but it is likely to produce all-or-nothing consequences. Ignoring the attention and consideration of specific circumstances and the content of the clause is more likely to lead to unfair and unreasonable results.

B. Analysis of the Guiding Judgments of Provincial High People’s Courts

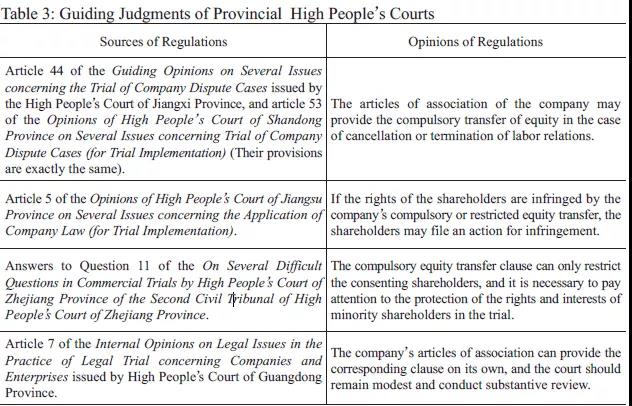

At present, there is no national legal regulation or judicial interpretation on the validity of the compulsory equity transfer clause in the articles of association or amendments to the articles of association. However, many local courts have explained this issue in their trial guidance opinions, as shown in the table below.

The views of these trial guidelines can be roughly divided into three types. The first type of view is that the articles of association can provide for compulsory transfer clauses without expressly requiring shareholders’ consent to be bound by them. Among them, the provisions of the High People’s Court of Jiangxi Province and the High People’s Court of Shandong Province are exactly the same. They recognize the validity of the compulsory equity transfer clauses in the articles of association regarding shareholders’ retirement, resignation, etc., and also provide specific transferees or transfer prices that are not specified by the articles of association, as well as the solution when there is no way to reach a consensus. The second type of view adheres to the theory of corporate contract. For example, High People’s Court of Zhejiang Province takes whether to obtain the consent of shareholders as the judgment standard. If the shareholders consent to the compulsory equity transfer clause in the form of signing the articles of association, they should be bound by the relevant provisions. Otherwise, the articles of association cannot force the transfer of shareholders’ equity. The third type of view holds that it is necessary to make a specific judgment based on the facts of the case. For example, at the same time the High People’s Court of Guangdong Province recognizes the validity of the compulsory equity transfer clause in the articles of association in principle, it also endows the courts with certain discretion, that is, it needs to review the parties’ intention and the specific contents of the terms, and then determine the validity of the clause after considering various factors. The High People’s Court of Jiangsu Province does not explicitly deny the validity of the compulsory equity transfer clause established by the articles of association, and points out that when there is a dispute over the validity of the compulsory equity transfer clause, the injured shareholder can bring a tort action.

Among these three types of views, the first and the third types of views do not clearly distinguish between the original articles of association and the amendments to the articles of association. Therefore, in practice, the judge still has some room for discretion. The second type of view distinguishes the initial articles of association and the amendments to the articles of association through the element of consent, because the initial articles of association are formulated after the unanimous consent of all shareholders, they are all valid; while the amendments to the articles of association are adopted by the capital majority rule, it is necessary to distinguish whether the expelled shareholders consent to the compulsory equity transfer clause to determine whether it is effective.

III. THE VALIDITY OF THE COMPULSORY EQUITY TRANSFER CLAUSE IN THE ARTICLES OF ASSOCIATION OF LIMITED LIABILITY COMPANY

As the carrier of compulsory equity transfer clause, the articles of association include the initial articles of association when the company was founded and the subsequent amendments to the articles of association. The former requires the consent of all the promoters or shareholders to fully reflect the wishes of shareholders; the latter only needs the capital majority rule, at which time the interests of small shareholders may be sacrificed. On the other hand, the establishment of a limited liability company has certain characteristics of a union of persons. In the initial stage of establishment, the promoters or original shareholders are often a relatively close community of shared interests. Even if only for the consideration of attracting investors, the majority shareholders will try to protect the interests of the minority shareholders and investors, so the initial articles of association often take into account the interests of all parties. However, in the process of continuous development of the company and the change of shareholders, this close relationship will continue to decline, and the minority shareholders will naturally be in a disadvantaged position in the game. On the one hand, compared with the majority shareholders, they are in a weaker position in terms of identification ability and influence; on the other hand, the cost of withdrawing from the company may force them to accept the amendments to the articles of association which is not conducive to themselves.

It is precisely because of the above differences that some scholars believe that the analysis of the validity of the compulsory equity transfer clause should distinguish between the articles of association and the amendments to the articles of association. For example, some scholars believe that it is legitimate that the initial articles of association have other provisions outside the Company Law, while it is generally not legitimate that the amendments to the articles of association have other provisions outside the Company Law. The contract theory treats a company as a connection point that integrates a series of private contract relations. Some scholars analyze it based on contract theory. As far as the initial articles of association are concerned, all the shareholders who consent to the articles of association to establish the company should be bound by them; because the amendments to the articles of association adopt the capital majority rule, there may be dissenting shareholders. Based on the logic consistent with the initial articles of association, the amendments to the articles of association are proposed effective only on consenting shareholders.

However, after this point of view is put forward, some scholars also raise an objection, believing that the distinction between the original articles of association and the amendments of the articles of association lacks legal basis and practical operation. Some scholars believe that the distinction between the original articles of association and the amendments to the articles of association will weaken the corporate nature of the Company Law. Moreover, it may also hinder the company’s articles of association from keeping pace with the times and self-improvement. The amendments to the articles of association often mean the reform and progress of the company. Therefore, it is not appropriate to consider the amendments to the articles of association to be of lower validity. On the other hand, the initial articles of association are subject to various conditions when they are formulated, and it is hard to cover everything, so more abstract articles of association give the company the possibility of flexibility within a certain range according to the market situation. Hence, the amendments to the articles of association are the product of the enterprise adapting to the market changes. If the original articles of association are treated differently from the amendments to articles of association, the flexibility of corporate governance will be reduced.

From the perspective of legal history, contract and partnership are the important origins of the organizational form of company. The laws and theories of the two legal systems embody the theory of corporate contract. However, as a typical business organization law, the Company Law has its own logical structure and discourse system. Coase believes that the company is a substitute for the price mechanism, reducing market transaction costs. As such an organization with capital accumulation, large-scale operation and continuous existence, it is impossible to fully apply the contract theory. If all shareholders are required to agree in decision-making, this organization will die due to the low efficiency of decision-making and eventually damage the rights and interests of all shareholders. The Company Law has a significant attribute of corporate law, which pursues group interests rather than individual interests. The theory of organizational transaction also believes that individual will should obey the group will to some extent. Limited liability company has a strong closed and community nature. At this time, the law should play a smaller role, and give way to people’s autonomy. In addition, the shares of limited liability companies are relatively concentrated, the subjects of ownership and control rights are the same, and the will of shareholders and the will of managers are more consistent. In practice, the shareholders often directly serve as the operation and management personnel. Therefore, the theory and practice of the Company Law should leave more sufficient space for the autonomy of limited liability companies. Some scholars have pointed out that the formulation of and amendments to the articles of association are actually joint acts. Based on the Company Law and the articles of association, the company should be allowed to appropriately and reasonably use various kinds of shareholder exit mechanism to maintain the stability of the operation structure of the limited liability company and the trust and cooperation relationship between the shareholders of the company. In the Guiding Case No. 96 issued by the Supreme People’s Court in 2018, the court affirmed the validity of the compulsory equity transfer clause set in the articles of association. One of the important reasons is that the limited liability company has strong characteristics of the union of persons and closeness, and should respect the autonomy of the company.

In principle, the autonomy of the limited liability company based on majority rule should be respected by the court, but we must realize that this is not absolute. It just means that in the absence of the intervention of other values, the value represented by the majority-based corporate autonomy is more important. Once the situation becomes concrete, it may involve other value factors. At this time, we still need to carefully conduct a comprehensive value measurement to get a proper conclusion. For example, article 9 of the Judicial Interpretation IV of the Company Law provides that shareholders’right to know cannot be substantially deprived based on a capital majority rule. The Beijing High People’s Court also believes that certain provisions of the Company Law or the company’s articles of association cannot be modified by a capital majority rule. Article 20 of the Company Law of China provides the prohibited behavior of shareholders. All of these indicate that, in some cases, based on the legitimate pursuit of the protection of the rights and interests of minority shareholders, we may have to restrict or intervene in the corporate autonomy based on the majority rule.

Regarding the issue of equity transfer, some scholars believe that no matter how members join the group, the clauses that make them lose their basic rights are contrary to public policy and have no effect. Therefore, equity, as the most basic right of shareholders, cannot be deprived. Scholars generally believe that the legal attributes of equity have both the attributes of personal rights and property rights, and are not simply obligatory rights, property rights, or personal rights. Equity is an independent right granted to shareholders by the Company Law, rather than an extension of a traditional right. In practice, the fundamental purpose of shareholders entering the company is also for monetary benefits, and various specific shareholder rights are essentially just to protect their interests. Therefore, to a certain extent, for individual shareholders, the key issue is not whether to allow the setting of compulsory equity transfer clauses, but rather the reason and price for the transfer. From a utilitarian point of view, it is necessary and significant to allow the articles of association to set compulsory equity transfer clauses at reasonable prices for legitimate reasons without violating the law and social and public interests. By examining the legitimacy of the compulsory equity transfer clauses, it is possible to maintain the character of a union of persons of the limited company, stimulate the enthusiasm of shareholders and employees, and to avoid clear unfairness by regulating the transfer price and other detailed rules. In the dispute mediation index of the World Bank’s business environment evaluation standards, question 10 relates to the invalidation or cancellation of the transaction. The World Bank explains that if a country’s laws provide that a transaction can be cancelled or invalidated when it is unfair or detrimental to the interests of shareholders, the score is the highest. Based on this, Professor Luo Peixin proposed the amendment to article 22 of the Company Law of China, adding considerations to the legitimacy of company resolutions, that is, ‘Where the resolutions are clearly unfair and harm the interests of shareholders, shareholders may request the people’s court to cancel the resolution within 60 days after the resolution is made’.

Therefore, in the case that the initial articles of association of a limited liability company and its amendments provide for the compulsory equity transfer clause, it is not precise and appropriate to simply divide its validity based on the sole element of shareholder consent. On the one hand, if the compulsory equity transfer clause is legitimate in terms of specific content, there is no need to completely negate it. On the other hand, shareholders’ consent may not be their true intention. Due to information asymmetry and limited judgment ability, it is often difficult for minority shareholders to identify whether the articles of association are beneficial to them, and when it is difficult to distinguish between good and bad, due to certain voting psychology, minority shareholders tend to vote in favor. In the more extreme cases, minority shareholders may ‘consent under duress’, and the company’s management may package multiple proposals to the shareholders meeting. At this time, because of some of the proposals, shareholders may be forced to accept the rest proposals that are unfavorable to them. The law is the art of pursuing fairness and justice. In judicial practice, the core of the problem is that the specific clauses are not legitimate (and the consent of shareholders is only a supplementary element or manifestation of this legitimacy), which is beyond the acceptance range of general social emotions. This makes us try to negate the validity of such clauses in the articles of association through various paths.

IV. THE ESTABLISHMENT OF STANDARD OF REVIEW

The deprivation of shareholders’ rights due to changes in the company’s articles of association and other circumstances should not be motivated by bad faith or other ulterior motives, and amendments to the articles of association should be developed in good faith for the company’s overall interests. Some scholars have conducted a substantive analysis of the contents of the articles of association or the amendments to articles of association. They believe that sticking to the distinction between the initial articles of association and the amendments to articles of association may cause minority shareholders to unreasonably restrict majority shareholders, and make all amendments to articles of association based on the overall consideration of the company invalid and lack flexibility. It further proposes a unified judgment standard for the validity of the compulsory equity transfer clause: First, the specific judgment was made based on the principle of prohibition of ‘shareholders’ suppression’ and the principle of proportion. The former means that once the terms of the company’s articles of association have the objective intention or effect of shareholders’ suppression, it would be confirmed to be invalid. The latter refers to the measurement of interests based on the specific situation; Second, a judgment is made based on two dimensions of ‘purpose standard’ and ‘fairness standard’, the former means that the company’s articles of association must be conducive to the realization of the overall interests, and the latter means that the articles of association should treat the dissenting shareholders of the resolution fairly. The above-mentioned review standards get rid of the simple model of judging the validity of clauses based on whether the shareholders consent or not, and to a certain extent expand the connotation of the compulsory transfer of bona fide equity. However, its discussion still has certain limitations. On the one hand, it does not consider the intention of shareholders; and on the other hand, it is more abstract and lacks concrete development. From the perspective of the composition of the clauses, the differences between the different compulsory equity transfer clauses mainly lie in two variables, namely the effective clause and the price clause. Therefore, the legitimacy of the compulsory equity clause should be implemented in the review of these two variables. In essence, the effective clause reflects the reason for the compulsory transfer of equity. As a starting point for an act, the legitimacy of the reason largely determines the legitimacy of the subsequent act; and whether the price clause of the equity transfer is fair concentratedly reflects whether the compulsory equity transfer clause is substantively legitimate. Minority shareholders have the right to obtain the fair market value of their equity when they exit the company. In judicial practice, the reason why people dispute the validity of the compulsory equity transfer clause is often because it is difficult for both parties to reach an agreement on the equity transfer price. Therefore, this article attempts to carry out typified research from two aspects: the legitimacy of effective conditions for equity transfer and the legitimacy of price clauses based on cases (see Tables 1 and 2 for details) in order to improve the judging criteria for the legitimacy of compulsory equity transfer clauses.

A. Legitimacy of Effective Conditions of the Compulsory Equity Transfer Clause

According to the study of cases, the conditions for the equity transfer to be effective mainly included the following: First, the shareholders cancel or terminate the labor relations and adjust their positions; Second, the shareholders lose some professional qualifications; Third, the shareholders have not fulfilled their corresponding obligations or have violated the rules of the company.

Among the above situations, the first situation is the most common one, which is to link shareholder qualifications to labor relations and job positions. If various situations that lead to the cancellation or termination of labor relations occur, shareholders lose their equity qualifications; if the corresponding shareholding ratio changes, the shares held must be increased or decreased accordingly. Four specific situations are involved: firstly, the shareholder dies; secondly, the shareholder loses the capacity to civil conduct; thirdly, the shareholder retires, resigns, or resigns because of a job transfer and other reasons to terminate the labor relations with the company; fourthly, the job position is demoted. Many state-owned enterprises and emerging technology enterprises have adopted this equity model. State-owned enterprises often establish an employee stock-holding system in their restructuring. For example, the High People’s Court of Jiangsu Province pointed out in the case Wang Shan v. Nanjing Jinling Petrochemical Engineering Design Co., Ltd. that this system allows former state-owned enterprise employees to become shareholders of the new company. The dual identity of shareholders and employees binds the interests of employees to the development of the enterprise, thus forming a new type of incentive and balance mechanism that combines distribution according to work and distribution according to capital. Emerging technology companies adopt equity incentive measures to reward and punish the company’s management or employees through the increase or decrease of equity. Once the labor relation is cancelled or terminated, and the original purpose cannot be achieved, the company will initiate the compulsory equity transfer clause and corresponding procedures. The second situation is relatively rare, and it is common in accounting firms and other enterprises that use professional knowledge or skills to provide corresponding services to customers and adopt the organization form of limited liability company. The court pointed out in the case of Zhangjiagang Xingrui Tax Agent Office (Limited Company) v. Wang Chen (dispute over company resolution) that: firstly, there is no law or administrative regulation providing that the shareholders of a tax accountant firm in the form of a limited liability company must be a registered tax agent; this is a compulsory transfer of shareholders’ equity; secondly, the loss of a shareholder’s qualification to practice as an accountant has not had a real impact on the company’s normal operation, so it cannot be used as a reason to force a transfer of shareholders’ equity. However, although the law does not provide for the qualifications of shareholders, it does not mean that the company’s articles of association cannot provide otherwise. On the other hand, it is difficult for an accounting firm to prove that shareholders’ loss of accountant qualifications has an impact on the company’s normal operations. Even if there is no impact, they should follow the conclusion of the capital majority rule. The third situation is also relatively rare, but its connotation is rich. Companies often set certain obligations in the articles of association based on actual conditions. The violation of these obligations by shareholders may lead to the compulsory transfer of equity. Common obligations include the need to pay the registration capital on time, not to do any work outside their own companies, not to do any business prohibited from the competition, and not to commit any crime. In practice, the court often affirms the validity of these clauses and approves their legitimacy.

In a word, the court should keep a humble attitude towards the condition of the compulsory equity transfer clause. Unless it is obviously unreasonable, it is not appropriate to deny the validity of the share transfer.

B. Legitimacy of Price Clause of the Compulsory Equity Transfer

According to the analysis of the relevant cases, it can be found that there are two main factors affecting the determination of the equity transfer price, namely, the calculation base and the calculation ratio. The calculation base refers to the initial basis for determining the equity transfer price. The determination mainly includes two modes: first, the original price at the time when shareholders make the capital contribution as the calculation base; second, the equity held by shareholders accounts for the value of the company’s net assets in the previous year as the calculation base.

The first method of determining the base number does not consider the changes in the value of the shares in the market environment. The value of the company depends on its original capital on the one hand, and on its business activities on the other hand. Its value is not fixed but always fluctuated. Calculating the transfer price based on the actual amount of capital contributed by the shareholders at the time of capital contribution is often not conducive to minority shareholders in practice. In most cases involving compulsory equity transfers, companies tend to operate well, and their net assets are much higher than their registered capital. At this time, the majority of shareholders may engage in opportunistic behavior out of their own interests. The market price of taking back shares in order to maximize their own interests has substantially infringed the property rights of minority shareholders.

Compared with the first method, the second method of determining the base number of calculations can better reflect the actual value of shares, but it still has certain limitations. It reflects the value that shareholders can obtain when the company is liquidated, but it cannot reflect the value of the company’s various intangible assets and future development potential, especially for technology companies, whose large amounts of proceeds are re-used as scientific research costs and then transformed into the potential value of the company, which cannot be reflected in this model.

The calculation ratio means that in practice, the determination of the equity transfer price often needs to be multiplied by a certain ratio (less than or equal to 100 percent). The product is the final equity transfer price, and the calculation ratio is often affected by factors such as the holding period, for example, multiplying the base number by a certain percentage based on the holding years. Specifically, the impact of the holding period on the transfer price includes two situations: Firstly, the transfer price is directly proportional to the holding period, that is, the calculation ratio increases with the holding period, and finally tends to 100 percent or a certain value; Secondly, the transfer price is inversely proportional to the holding period, that is, the calculated ratio decreases with the holding period, and finally tends to 0 percent or a certain value. In addition, the company’s articles of association impose further restrictions on the transfer price based on one of the above price determination modes through various methods, and even directly provide that the purchase price is a certain percentage of the calculation base. In this type of equity transfer clause, there is even a zero yuan transfer clause. For instance, some companies’ articles of association provide that the transfer price shall be determined according to the company’s net assets, but the premium part of the net asset appreciation shall not exceed a certain proportion of the original capital contribution of the equity. Some companies’ articles of association provide that the equity must be transferred within a time limit. If the transfer is not made within the prescribed time limit, the proceeds from the non-transferred equity proceeds belong to all shareholders.

In addition to the above-mentioned specific provisions on the method of determining the transfer price in the equity transfer clauses, there are also companies that only make abstract provisions on the transfer price in the equity transfer clauses, such as the determination through the consultation by the shareholders meeting and other institutions. ‘Determination through consultation’ is a less precise method of determining the transfer price, which is prone to disputes, makes it difficult to carry out equity transfers, and is used by relatively few companies. Using the board of directors or the shareholders’ meetings to determine the transfer price can easily lead to the tyranny of the majority.

The Company Law of China does not provide for the price clause for compulsory equity transfer in the articles of association. However, article 74 of the Company Law provides the repurchase rights of dissenting shareholders, that is, under certain circumstances, dissenting shareholders may require the company to purchase their shares at a reasonable price. Although it is not completely consistent with the situations discussed in this article, it still has certain reference value, because both explore how shareholders can determine a reasonable price when transferring equity due to factors other than themselves. In the practice of the Company Law of China, the following methods are usually used to determine the equity transfer price: firstly, using the capital contribution as the transfer price; secondly, calculating the transfer price based on the company’s net assets and the proportion of equity; thirdly, using the auction and sale prices as the transfer price; fourthly, taking the audited and assessed price as the transfer price. The first two are reflected in the cases sorted out in this article. The auction is more applicable to equity transfer issues in joint-stock companies. Auditing and evaluating prices are more beneficial to the expelled shareholders, but not conducive to maximizing the interests of the company or majority shareholders, and they are rarely used in practice. As mentioned earlier, regardless of whether the equity transfer price is determined by the amount of capital contribution or the amount of the company’s net assets, although it has certain rationality, it also has its limitations and is often not conducive to equity transferors. The reason why most of these models are adopted in practice is largely due to the uncertainty of the equity price itself, the relatively weak liquidity of the shares of a limited liability company, and its actual value often requiring economic analysis and calculation. And this is beyond the competence of most of the judges.

In the comparative law, various countries also have some regulations for dissenting shareholders’ equity repurchase, trying to determine reasonable equity transfer prices from various angles. Paragraph 3 of article 2473 of the Italian Civil Code provides that the equity transfer price shall be determined according to the market price at the time when the withdrawal is announced. If consensus cannot be reached, it shall be evaluated and determined by experts. Article 355-5 of the Commercial Act of Republic of Korea provides that the transfer price shall be determined through consultation. If consensus cannot be reached, it will be determined by experts or the court. The Louisiana Limited Liability Company Law of the United States provides that the equity transfer price should be the fair market value of the equity held by the shareholder on the day of his withdrawal or resignation, and the court shall not apply any other appraisal method. In addition, other states in the United States also use economic methods such as discounted cash flow to determine the transfer price. Although the perspectives are different, these regulations can give us two enlightenments in general. First, it is not legally reasonable to determine the calculation ratio through factors such as holding period, and then to limit the transfer price. Despite its commercial considerations, it does not meet the legal requirements for fairness and justice, especially the zero-yuan purchase clause. Second, strengthening the financial means and shareholders’ appraisal rights in this field. Some scholars point out that the share appraisal right of the dissenting shareholders has evolved a new function from the traditional function of providing a fair way to withdraw from the shareholders, which is to monitor and reduce the majority shareholders’ opportunism against the minority shareholders under the background of a conflict of interests. The court could check whether the majority shareholders are in good faith according to the realization of the minority shareholders’ appraisal right. Actively building a communication mechanism between the court and relevant experts and institutions, and determining relatively reasonable prices through financial means such as market appraisal serve as the basis for the court to evaluate the legitimacy of the compulsory equity transfer price clause on the one hand, and fill in gaps when the price clause is not legitimate or not agreed on the other hand.

Based on the above discussion, this article attempts to restructure the judicial review approach of the compulsory equity transfer clause in the articles of association. The Company Law must balance its corporate and private nature, and it is not appropriate to deny its validity based solely on the dissenting shareholders’ disapproval of equity transfer clause. The benefits of various values must be measured to determine the legitimacy of the clause, but the shareholders’ consent or objection should have an impact on the legitimacy. Specifically:

First, the equity transfer clause in the articles of association and its amendments do not specify the method for determining the price, or it is planned to adopt the method of determination by the shareholders meeting, consensus, or other methods, and no agreement can be reached afterwards. In this case, shareholders lack the possibility of foreseeing the specific circumstances of the compulsory equity transfer in the future. Therefore, it is advisable to construct a communication mechanism between the judge and the asset appraisal agency, which shall be determined by the judge or the relevant asset appraisal agency shall be determined through consultation by the parties. The principle of economics shall be applied to establish reasonable prices through the review of the company’s net assets, commercial books and other materials.

Second, circumstances in which the equity transfer clause in the articles of association and its amendments provide the method of price determination. Firstly, for shareholders who consent to the initial articles of association or amendments to the articles of association, their consent to a certain extent compensates for the lack of reasonableness of the price clause of the articles of association, so the review of the price clause can be appropriately relaxed. However, because the consent is consent in advance, in practice minority shareholders often fail to truly understand the possible consequences of the clauses or express their true intentions beforehand for various reasons. Therefore, in this case, the law should still take into account the fairness and justice and the reasonable realization of the equity value of minority shareholders. Situation One: If the price clause is based on the market appraisal price or the capital contribution as the transfer price, or the transfer price is calculated based on the company’s net assets and equity ratio, its validity can be determined. Situation Two: If the price clause further stipulates that the calculation ratio is used to limit the equity transfer price, the validity of the calculation ratio should be denied. If the two parties cannot reach an agreement on the new price (that is, the transfer price is determined based on the calculation base in the case), the equity transfer clause shall be invalid or voidable. Situation Three: If other methods are used to determine the transfer price, it shall be valid in principle, unless the court deems that it is not justified by the situation.

Secondly, for the dissenting shareholders of the amendments to the articles of association, due to the lack of intention to make corrections, higher requirements are placed on the legitimacy of the price clause. At this time, it is necessary to ensure the fair realization of the appraisal right of dissenting shareholders. Unless the articles of association provide for market valuation, the validity of the price clause should be denied. The relevant asset appraisal agency shall be designated by the court or negotiated by the parties to establish a reasonable price through the review of the company’s net assets, commercial books and other materials. If the parties accept the new equity transfer price, the validity of the equity transfer clause shall be affirmed; if the agreement cannot be reached, the validity of the equity transfer clause shall be denied.

V. CONCLUSION

With the deepening and reform of corporate governance, a large number of compulsory equity transfer clauses appeared in the company’s articles of association and its amendments, which caused many disputes. The company’s autonomous behavior based on majority rule should be respected by the courts, but the phenomenon that majority shareholders use the articles of association to deprive the minority shareholders of their legitimate rights and interests based on their strong position cannot be ignored. Excessive adherence to the majority rule may lead to a disconnect between legislation and practice. The law cannot be applied without being interpreted, and judicial review needs to be fair and just under the logic of law. Therefore, many scholars have incorporated the consideration of mutual assent on this issue, but mutual assent is not completely equivalent to legitimacy. On the one hand, even if there is no mutual assent, the specific clauses themselves may be legitimate; on the other hand, due to information asymmetry for other reasons, even if the compulsory equity transfer clauses are approved by shareholders, they may still be clearly unfair. In essence, the compulsory equity transfer clause should be based on good faith for the company’s benefit. Such legitimacy is reflected in the effective conditions and price clause. Mutual assent is only a supplementary element of the legitimacy of the clause. The court should maintain a modest attitude towards the effective conditions of the compulsory equity transfer clause. As for its price clause, a more complex type of analysis is required to take into account the overall interests of the company and the protection of minority shareholders. Regarding the issue of the legitimacy of the equity transfer price in a limited liability company, how to deepen the cooperation between law and economics in order to promote the reasonable distribution of interests between the company and shareholders, and between the shareholders is still a problem worthy of further study.