BIAS AND CORRECTION OF INTEREST RATE RESTRICTION IN NETWORK LENDING INDUSTRY

Qin Kangmei

TABLE OF CONTENTS

I. INTEREST RATE STATUS OF NETWORK LENDING INDUSTRY IN CHINA

II. JUDICIAL ATTITUDE OF INTEREST RATE RESTRICTIONS IN CHINA’S NETWORK LENDING INDUSTRY

A. Judicial Investigation of the Relationship between Interest Rates and Inter-residential Rates

B. Judicial Investigation of the Relationship between Interest Rates and Default Payments

III. THE PROBLEM OF INTEREST RATE RESTRICTION IN THE NETWORK LENDING INDUSTRY

A. An Examination of the Relationship between Interest Rates and Intermediary Expenses

B. An Examination of the Relationship between Interest Rates and Default Funds

C. How to Choose between Legal Restrictions and Industry Self-discipline

IV. EXPERIENCE STUDY OF INTEREST RATE RESTRICTIONS IN EXTRATERRITORIAL NETWORK LENDING INDUSTRY

A. Practice Review of Interest Rates in Extraterritorial Network Lending Industry

B. Legislation Review of Interest Rate in Extraterritorial Network Lending Industry

C. An Analysis of the Practice and Legislation of the Interest Rate of Extraterritorial Network Lending

V. RECONSTRUCTING THE INTEREST RATE RESTRICTION SYSTEM OF CHINA’S NETWORK LENDING INDUSTRY

A. The Independent Application of Interest Rate and Intermediary Rate

B. Merger Regulation of Interest Rates, Default Payments and Other Items

C. The Combination of Market Adjustment and Industry Self-regulation to Regulate Emerging Industries

VI. CONCLUSION

Because of the direct contact between the borrowers and the lenders, the interest rate of the network private lending industry has been lowered. At the same time, because of omitting the intermediate links, the lender's income has also increased, thus the network private lending can achieve a win-win situation. However, there is an invisible interest rate in the online lending industry, which increases the financing cost in a disguised way. To eliminate this undesirable phenomenon, the current judicial field has adopted to incorporate all borrowers' expenses into the interest rate range and made the sum of all costs not exceed the legal interest rate ceiling. In the judicial field, the unlimited expansion of the interest rate range will break through the relativity of debt and make the behavior of intermediary institutions subordinate to the loan contract. The inconsistency between the payment time of interest and intermediary expenses will make the judicial viewpoint of unification of interest rate range contradictory. Therefore, the judicial field should recognize the relativity of debt, separate the intermediary rate from the interest rate, leave the intermediary rate to the market regulation and supervised by the industry's self-regulatory organizations and regulatory authorities. The unified restriction of interest rate should include all kinds of expenses and default costs, which are agreed in the loan contract, so as to promote the substantial reduction of financing costs. In the meantime, it is necessary to unify the information disclosure of financing costs so that both borrowers and lenders can realize their free choice.Network lending is essentially private lending of the network lending platform as an intermediary to meet the two sides of the loan directly. The network lending industry has been through rapid development, bringing about the intensification of market competition, of which interest rates are the focus of competition of these network lending platforms. It is also a hot spot for consumers. Ceyhan and others, on the basis of studying the bidding mechanism of the P2P network lending platform, think that interest rate is an important factor for the borrower to consider when choosing the lender. The ideal network lending rate should break the traditional interest rate pricing model dominated by lenders and financial intermediaries, while credit risk-led pricing and interest rates are spontaneous. However, the ability to make a deal between the lenders and borrowers depends on the platform's professional judgment, transparent information, and the high interest rates of the project. Due to the lack of expertise of lenders, there may be less attention to platforms and information, and more attention to high-interest rate projects. And high-interest projects will have a high risk and high default rate, which will bring many default items, resulting in low-risk tolerance of the lender which will exit the network lending industry. The rest are high-risk lenders, and high-risk lenders will pay attention to high interest rate projects, thus the market will only have high-risk projects. In the long run, low-risk lenders and low-risk projects will be expelled from the industry. The market will not be healthy, and the high interest rates are not real market lending rates, so that there will be interest rate failure. Therefore, the interest rates in network lending industry need to be reregulated. I. INTEREST RATE STATUS OF NETWORK LENDING INDUSTRY IN CHINAFrom Wu Ying was arrested in March 2007 to the final trial of Wu Ying Case on January 2012, during which the outbreak of high interest rates of private lending across the country, causing heated discussion from all walks of life how to effectively promote private capital into the real industry, and Wu Ying Case promotes the rapid development of network lending industry. The rapid development of the network lending industry has increased the effective idle funds in the capital market, and the combination of the Supreme People's Court's Judicial Interpretation of Private Lending of 2015 has accelerated the decline in private lending rates. According to data from Net Loans, a well-known third-party advisory firm, in February 2019, the online loan industry shows, the comprehensive rate of return is 9.94 percent, whether the interest rate in the network industry is transparent, or this rate of return represents the main cost of the borrowers' financing, or whether there is a hidden interest rate problem are unclear. Feng Guo believes that the cost of financing the network lending industry accounts for a large portion of the cost of financing in addition to the usual interest rate. The network lending industry is widespread and is suspected of having disguised interest rates where investors in addition to receiving the interest rate paid by the borrower also received the platform's so-called reward rate and the two combined will exceed the limit of the private lending interest rate stipulated by China's law. In 2015, the High People's Court of Jiangsu Province conducted a survey on the network lending industry and found that the borrowing cost of borrowers in the online lending platform is generally higher, taking the Jiangsu network lending platform as an example. The fees that borrowers face in the online lending platform are: top-up fees, the borrower's online top-up, will be charged 0.1 percent handling fee; and borrowing management fees, according to whether or not guaranteed, borrowing priorities, etc. divided into different fees, up to 2 in 1,000 per day. In June 2015, the combined interest rate for the online lending industry was 20.29 percent. In 2016, the average annual interest rate of 5.75 percent of online lending platforms was more than 24 percent and the interest rate of 2.09 percent of P2P network lending platforms was more than 36 percent. This data shows that the network lending industry has a variety of purposeful inter-payments, resulting in increased financing costs for borrowers since the Supreme People's Court's Judicial Interpretation of Private Lending of 2015 only sets interest rate ceilings and does not address other costs associated with borrowing. Nevertheless, the existence of hidden interest rates not only increase the cost of borrowers, damage the image of the network lending industry as an emerging industry, but also makes this emerging industry with low interest rates to solve the problem of financing expensive features gradually die out. II. JUDICIAL ATTITUDE IN INTEREST RATE RESTRICTIONS OF NETWORK LENDING INDUSTRY IN CHINA Invisible interest rate in network lending industry stems from intermediary fees and default payments and other fees. Judicial practice on whether the interest rate includes intermediary rates and default payments and other fees has different attitudes, which needs to be combed and analyzed. A. Judicial Investigation of the Relationship between Interest Rates and Inter-residential RatesIn the field of judicial practice, there are three different standards of adjudication for the scope of interest rates. 1. Do Not Determine That the Interest Rate Range Includes Inter-residential Rates. — The first view in judicial practice is that interest rates do not include interstitial rates, and the representative case is the Dotmelt Network v. Li Case of the 5th civil court of Huangpu District People's Court of Shanghai in 2014, in which the plaintiff, Shanghai Dianrong Financial Information Services Co., Ltd., which owns its website provided lending services. On September 29, 2013, through the website defendant Li (member number 93519) and 264 people reached the intention to borrow, a total of 500,000 yuan, after the defendant overdue repayment, 264 creditors transferred the claim to the plaintiff platform company, the plaintiff then sued to the court. Defendant Li argued that the plaintiff platform company deducted the platform accommodation fee from the borrower in advance. According to the contract law interest cannot be deducted in advance, so the platform intermediary fee should be deducted from the loan of 500,000 yuan after interest. The court held that the lender's loan legal relationship with the borrower and the network platform and the borrower's inter-service contract relationship are different legal relations, and that the settlement fee between the client and the borrower is a legal relationship between the platform and the borrower, based on the intermediary contract, which cannot affect the interests of the lender, so the nature of the interstitial service fee in this case does not belong to the loan interest, and the principal of the loan to the lender's actual loan amount of 500,000 yuan as the calculation standard, which is more in line with the essence of the contract, the interstitial fee can be directly deducted in the principal in advance. The court held that the cost of residence and interest were divided into two different contracts, which could not be calculated in combination and were paid at different times. 2. Determining the Range of Interest Rates Includes Inter-residential Rates. — The second view on whether the interest rate in the network lending industry should include the intermediary rate and should be calculated by the combination of the intermediary fee with the lender's interest to uniformly apply the statutory limit of interest rate is represented by a case of the High People's Court of Jiangsu Province in 2015. On August 10, 2015, the High People's Court of Jiangsu Province issued the Trial of Private Lending Cases in Jiangsu Court, which published the top ten typical cases of private lending. The 8th case of which is P2P platform to provide inter-service for private lending. The disguised high-fees are not supported by the courts In this case, Company A in July 2012 in the form of P2P nonpublic mortgage notarized loan for the lender Jiang, and loaned the borrower Ding a provision of 600,000 yuan of financial services. Ding mortgage all of his houses for the mortgage registration, the mortgage is Jiang's guarantee. The company charges a total of 0.25 percent of the service fee and management fee to Jiang in accordance with the amount of the loan, and 0.5 percent of the consulting fee, management fee and service fee to Ding each month. At the same time, Ding issued a receipt?for?a?loan to Company A, the amount of the loan is 720,000 yuan, and the term is 6 months. After the loan is due, Ding did not return the loan according to the contract, Company A and Jiang held Ding's power of attorney to directly transferred the mortgaged house to Jiang. Because of Company A's consulting fees, management fees, service charges were to no avail, so the case was taken to court. In this case, the platform company charged the borrower a total of 1.5 percent of the consulting fees, management fees, service fees, which is 18 percent a year. If adding to the payment of the lender's interest; the borrower's cost will be very high. The court eventually determined the interest and interest on monetary debt as a disguised form of the advisory fee, management fee, service charge, etc., thus applying the rule that the interest rate of private lending should not exceed four times the bank's similar interest rate was adjusted, and the excess was not supported. 3. The Provision of Excessive Intermediary Rate Will Confirm Invalidity. — Whether the network lending rate includes the third judicial view of interstitial rate does not deal with the relationship between the two, but the intermediary rate is regulated according to the interest rate. This view is represented by a case decided by the Second Intermediate People's Court of Shanghai in 2013. On December 2, 2010, Liu signed a Credit Advisory and Management Services Agreement with Yixin, and on December 2, 2010, Tang loaned Liu a principal amount of 299,850.07 yuan of which payment was paid to Yixin Company service fee of 99,850.07 yuan, remittance to Liu a 200,000 yuan, with interest according to the annual 6.672 percent calculation. After a non-payment Liu was sued. After two trials, the focus of the dispute is the determination of the amount of borrowing between the settlement and the reasonableness of the intermediary service fee. The court found that the service fee ratio involved in the case was as high as 33 percent, resulting in reasonable doubt about the service content and service fee difference. The court ultimately found that Yixin Company in the name of charging a service fee to obtain high interest is a legitimate form to cover up the illegal purpose, so the amount of the loan in this case should be Tang's certain actual delivery amount, that is, 200,000 yuan. In this case, although the court did not clearly define whether the residence fee is the interest, the high interstitial fee was not recognized, and the actual amount of the loan was based on the judgment. With the interstitial fee as an interest measure, interest may not be deducted in advance in the principal, and interest shall be subject to the statutory interest rate provisions set by the Supreme People's Court and shall not exceed the provisions, but the court has not commented on when the intermediary fee will be paid. In summary, how to calculate the interest rate of network lending and whether it includes inter-residential rate or not, is currently in an uncertain state. The judicial practice of the referee's point of view is not uniform, for the development of the network lending industry is very unfavorable. 4. The Latest Views of Judicial Practice. — On August 4, 2017, the Supreme People's Court issued Several Opinions on Further Strengthening the Work of Financial Trials, which stipulates in paragraph 7 of article 2, that the provisions of the judicial protection ceiling for private lending interest rates in the form of intermediary expenses of the internet lending information intermediary and the lender shall be found invalid. This provision indicates that the network lending industry has high comprehensive financing costs and a disguised interest rate increase, but this article only stipulates the behavior between the network lending intermediary and the lender, and the network lending is essentially the behavior between the borrower, the lender, and the network lending industry. The judicial interpretation of whether interest rates should include other fees paid by borrowers is not clear. At the same time, if the prescribed interest rate includes the intermediary rate and the cost of the intermediary can be paid at the time of borrowing, the Supreme People's Court also does not provide for this, which will lead to the interest rate of the organization, but the intermediary fee can be paid in advance. The interest on the loan is still calculated on the basis of the agreed amount of the loan. B. Judicial Investigation of the Relationship between Interest Rates and Default Payments1. Adjudicating Cases. — Stealth interest rates, in addition to being achieved through interstitial rates, can also be reflected in the terms of the default payment in the contract. The case of the loan dispute between Dalian Gaojin Investment Co., Ltd. and Dalian Deheng Real Estate Development Co., Ltd., which was decided by the Supreme People's Court on December 22, 2017, is represented. Although this case is not a case of online lending, it applies to the online lending interest rate provision because it is a private lending case. The lender has been engaged in foreign borrowing business many times; the borrower has many different borrowing subjects. They did not agree on interest, but agreed to high late interest or default. The two borrowing contracts involved in the case were part of their lending operations. And the two borrowing contracts did not agree on interest over the loan period, which was three months, with the default payment exceeded four times the bank's borrowing rate for the same period. The company ultimately failed to recover the two loans in the case. The Supreme People's Court ultimately held that Gaojin was an investment company with no foreign lending business in its business scope, its lending business had not been approved by the financial regulatory authorities, the two borrowing contracts were invalid, and the contract agreed to a default payment exceeded four times the bank's borrowing rate for the same period. In the case of a profit-making purpose in the form of a high default payment or a high overdue interest, the interest rate during the invalid period is protected by the benchmark interest rate for the same period as stipulated by the People's Bank of China. It can be seen that the default payment in private loans will also become a dominant lender and intermediary to raise interest rates in disguise. 2. Related Regulations. — Article 30 of the Provisions of the Supreme People's Court on Certain Questions of the Law Applying to the Trial of Private Lending Cases in 2015 stipulates: 'The lender and the borrower have agreed not only on the overdue interest rate, as well as the default payment or other expenses, and the lender may choose to claim the overdue interest, breach of contract or other expenses, but the people's court shall not support the portion that exceeds the annual interest rate of 24 percent.' Thus, in judicial practice, the cost of default has also been included in the range of interest rates for merger restrictions. III. THE PROBLEM OF INTEREST RATE RESTRICTION IN THE NETWORK LENDING INDUSTRY

A. An Examination of the Relationship between Interest Rates and Intermediary ExpensesThe lending rate should be the consideration paid by the borrower to the lender, essentially compensation for the lender's renunciation of the right to use the currency. The price of the loan contract should be the interest charged by the lender to the borrower, but the network lending industry is the intermediary to provide information services to facilitate the transaction, whether the intermediary's service rate is included in the interest rate is a question worth considering. At present, there is a hidden increase in interest rates in this industry, mainly in the disguised increase in inter-provincial expenses, therefore, the High People's Court of Jiangsu and the Supreme People's Court limit the disguised increase in intermediary costs through the typical case form or opinion form. The court's view is that the increase in the cost of intermediary will make the borrower's comprehensive financing costs exceed the legal interest rate ceiling. However, such restrictions pose a series of problems.First, when the cost of the intermediary is paid. As in the three cases studied above, a borrower has suggested that the cost of the intermediary cannot be withdrawn in advance, and that interest should be calculated after deducting the principal fee from the interbank fee if the advance withdrawal is to be made. If the interstitial rate is specified as an interest rate component and cannot exceed the statutory interest rate ceiling, interest can only be paid after maturity, whereas in practice the interstitial is paid first at the time of the loan. Just as some courts decide that the intermediary fee is not the interest, the intermediary fee is the fee that the intermediary should charge when facilitating the transaction. Although the typical case of the High People's Court of Jiangsu and the latest opinion of the Supreme People's Court limit the borrower's comprehensive financing cost and limit the intermediary fee, it cannot legally explain why the intermediary rate can be withdrawn in advance after the interest rate is part of it.Second, how the legal relationship between intermediary rate and interest rates is combined. Interest rate is that the borrower pay for the use of funds when the lender transfer funds to the borrower. This is the result of the loan contract. The intermediary fee is the paid fee incurred by the intermediary to provide the intermediary service to the client. The intermediary service of network lending is generated between the intermediary and the lender and the borrower, and the contract amount generated by the intermediary platform to the lender and the borrower respectively after the brokering of the intermediary transaction. Interest rates and interbank rates are completely different legal relationships, and why they should be combined into interest rate limits are clearly incompatible with the relativity of debt.Third, whether the cost of other intermediary services also needs to be included in the statutory interest rate limitation. Network lending requires intermediary facilitation services, and intermediary services are not limited to the services provided by intermediary platforms for both borrowers and lenders, but also include assessment services provided by assessment agencies, registration services provided by the registration section, accreditation services provided by the identification department, and various intermediary services such as legal services and audit services provided by intermediaries. The Supreme People's Court only limits the intermediary service charge, and other services that are also intermediary services, and why the cost of other services is not within the limits. This practice of treating intermediary services differently cannot find the relevant legal basis.B. An Examination of the Relationship between Interest Rates and Default FundsIn addition to the interest rate and intermediary fees, the borrower's comprehensive financing costs also include liability for default when it cannot be repaid. Interest rate is a kind of consideration of the loan funds charged by the lender to the borrower. The default payment is that the loaner ask for the borrower's failure to perform the contract to collect compensation or sanctions. They both are that the lenders ask for based on the same loan contract to collect different purpose fees, default payment and interest rate. Corresponding to the joint existence has been the focus of academic controversy. Private lending rate has statutory limits, default payment is not a legal limit, only with the loss should be adjusted, interest rate and default payment in their respective limited areas play their respective roles, but the combination of interest and default may exceed the statutory limit, which may also exceed the loss caused by the contract, if the two are allowed to play an independent efficiency. In a difficult lending market, lenders may raise interest rates in disguise through high default rates. Article 30 of the Supreme People's Court's Provisions on Certain Questions of the Law Applying to the Trial of Private Lending Cases of 2015 provides only for the relationship between overdue interest rates and default payments and other expenses, i.e., the statutory interest rate ceiling cannot be exceeded, but this does not state that the agreed interest rate shall also be agreed whether there is a limit to the overdue interest rate, default payment or other expenses. Does it mean that the interest rate plus overdue interest rate and default payment and other expenses sum up to 24 percent of the annual interest rate? Judicial interpretation on private lending of the Supreme People's Court does not specify this.C. How to Choose between Legal Restrictions and Industry Self-disciplineNetwork lending belongs to private lending. The implementation of the legal limit of private lending interest rate has always been adopted in China. The cost of residence belongs to another contract relationship and the service fee collected by the network lending platform is also the reasonable consideration of the contract. Network lending industry has experienced an early unmanageable development process to increase supervision in 2016. The current network lending industry has entered the era of strict supervision, while increasing the industry self-regulatory organizations to self-regulate the management of the industry. After the increase in industry self-regulation and administrative supervision, whether the law will also need to limit the cost of living, whether the legal restrictions will become decoration without substantive needs, and whether the legal restrictions will hinder the free competition of the market and the development of emerging industries.In summary, the legislation for the borrower's comprehensive financing costs need to be limited. It needs to be legally re-analyzed whether the restriction to the inter-intermediary costs and default payments are unified within the interest rate range or to adjust the difference.IV. EXPERIENCE STUDY OF INTEREST RATE RESTRICTIONS IN EXTRATERRITORIAL NETWORK LENDING INDUSTRYA. Practice Review of Interest Rates in Extraterritorial Network Lending IndustryThere is no special legislation on online lending rates in the US, but online lending platforms have uniform rules on the range of interest rates. The network lending rate is calculated according to the borrower's payment to the lender, or to the interest paid by the borrower plus the platform intercourse fee. The US network lending platform is generally clearly stated. Lending Club, one of the US online lending platforms, said on its official website that the platform's annual lending rate, Annualised Percentage Rate (APR), includes borrowing rates and fees charged by the platform, and that APR is the best way to quickly compare the cost of different loans, ranging from 6.95 percent to 35.89 percent. Prosper, another major US online lending platform, also uses the combined cost of borrowing on its website to represent APR from an annual interest rate of 5.99 percent to 36.00 percent, depending on the credit worth of each borrower. The US Treasury Department's Online Lending Market Research Report released on May 2016 shows that small micro-companies that received loans from online lending platforms in 2015 were not satisfied with their successful loans. According to the Small Microenterprise Credit Research of 2015, borrower satisfaction is only 15 percent. The most disgruntled is that 70 percent of companies think the loan rate is too high. Some online lending platforms offer significantly higher interest rates than financial institutions, and some even offer 36 percent interest rates to borrowers with a Fair Isaac Corporation credit score of 580. Thus, the borrowers in the US online lending market are dissatisfied with the existence of online lending. The dissatisfaction is that the network lending industry has a high interest rate phenomenon, but such high interest rates are not because of the existence of hidden high interest rates, but it is because different credit scores bring different interest rate costs.The practice of UK online lending platforms is similar to that of the US online lending. Zopa platform rates range from 4.8 percent to 34.9 percent. Zopa platform defines the term definition used on its official website, and the loan rate is composed of the loan rate and the platform service rate. The RateSetter platform also states on its official website that the loan rate will be expressed at an annual rate, including the payment of the lender and any fees or interest rates paid to the RateSetter platform. And Funding Circle has also stressed on its official website that the loan rate will be expressed at an annual rate. The fees charged are included in the interest rates set out in the loan contract and paid directly in the loan signed. Thus, in the UK, the interest rate of the online lending platform includes the payment of the interest rate given to the borrower and the fees paid to the online lending platform. Internet lending interest rates of the UK is satisfactory, Peer-to-Peer Finance Association (P2PFA) commissioned a third-party consulting company OXERA to conduct research on the development of the Peer-to-Peer (P2P) industry in 2016. OXERA co-published a study on the P2P industry with P2PFA in September 2016, which concluded that the online lending industry provides society with a relatively reasonable interest rate, currently between 4 percent and 8 percent, including consumer and commercial loan rates. Thus, the UK's online lending rate is relatively low and more conducive to social development.In terms of reality in the US and the UK, interest rates are one of the most important factors in the public's judgment of the online lending industry. The UK people's high satisfaction with the status quo of the online lending industry is due to the better regulation of the UK internet lending industry, mainly reflected in two aspects. Firstly, the implementation of the standard approach of interest rates is worth learning. The interest rate of the network lending platform for the project on the platform includes all the part of the borrower's expenditure, including the cost of residence. The unity of the two is conducive to the transparency and comparison of information, comparing the US and the UK, China's network lending industry. The difference between the interest rate level and the interest rate of these two countries is not obvious except that the maximum interest rate is not more than 24 percent of the statutory interest rate, but the US and the UK use the comprehensive financing cost rate, and China is using the rate of return, and the cost is not calculated in a unified way. It could lead to inappropriately raising inter-bank fees for online lending platforms to raise borrowers' financing costs in disguise, bypassing the interest rate cap. Regulations of the UK for the network lending are relatively loose. network lending legislation is only a principle provision, the more is to carry out self-regulation by the industry self-regulatory organizations. Legislation easing will attract more capital into the private lending industry. The formation of low interest rates helps the UK at the forefront of network lending industry in the world. In contrast, the US regulations for the network lending are more stringent. The platform operating costs will be high, resulting in high financing costs and people's dissatisfaction with high interest rates. B. Legislation Review of Interest Rate in Extraterritorial Network Lending Industry1. The US Legislation. — Many US states regulate interest rates and some people divide them into two parts, interest rates and the other costs, bypassing the high interest rates in regulated states, especially when US banks charge for credit cards issued, because of state regulation of interest rate caps. Bank of America has a variety of items for credit card fees, membership fees, service charge and deferred payments, which are higher than the state's upper limit on interest rates. Section 85 of the National Banking Act of 1995 with respect to interest on credit cards (interest) was extended by the Office of the Comptroller of the Currency of the US, arguing that interest includes any compensation for payment of deferred payments to creditors or future creditors, including annual credit card fees, membership fees, deferred payments, etc. This does not include, however, the fees paid to third-holders, such as appraisal fees, notarization fees, insurance premiums, assessment fees and expenses incurred to obtain credit reports. In 1996, the Federal Court of the US again adjudicated the interest rate on credit cards in Smiley v. Citibank Case, in which the plaintiff was a California resident who owned two Citibank credit cards (registered in Sioux Falls, South Dakota), under the Citibank credit card agreement. If the cardholder fails to repay on the specified repayment date, the issuing bank will charge a monthly delay payment of 15 US dollars or 0.65 percent of the outstanding amount, with a large amount of charge. The plaintiffs argued that the agreement violated the rules of the residence state, which did not violate the South Dakota rules, and filed a class-action lawsuit, and the federal court ultimately confirmed the Office of the Comptroller of the Currency of the US's extended interpretation of the bank card rate. Thejudiciary and administrative agencies of the US spend money on credit cardholders in two parts: all fees paid to the issuing bank, that is, all fees for the counterparty, and third-party fees to be paid to the counterparty. Interest rates should include all expenses paid to the counterparty, not to third parties, and all expenses paid to the counterparty should be subject to state interest rate control.There are three aspects of the US network lending rate practice worth learning from. Firstly, the interest rate is applicable to differential treatment, which is recommended. According to data released on the two major platforms of the US, the network lending industry has a range of interest rates, low interest rates, and very high interest rates, and the level of interest rates are closely related to the borrower's credit score. However, according to the American people's dissatisfaction with the online lending rate information feedback, on the one hand, the borrower's low interest rate expectations for online lending rates are high. On the other hand, because of the borrower's credit rate is different, the application of high interest rates should be poor credit borrowers, which also shows that people with poor credit use online lending as their main means of financing. Otherwise, they may not have other ways of financing. This is very helpful to the transparency of the interest rate of online lending, which China can learn from.2. Legislation in the UK. — The attitude of the UK to private lending rates has been gradually relaxed. Until the 1850s, there was special legislation in the UK against high-interest borrowing. In 1542, King Henry VIII enacted the Anti-Usury Act, which capped private lending rates, and in 1660, the Parliament enacted the Anti-Usury Act, which capped private lending rates at 6 percent. In 1854, the Parliament of the UK repealed the Anti-Usury Act of 1660. In 1974, the Parliament repealed the consumer lending rate limit of 48 percent in the Consumer Lending Act. Ireland originally made it illegal to set an annual interest rate of more than 39 percent, which was no longer protected by law, but the restriction was lifted in 1995, and since then, the way the private lending rate has been regulated in the UK has changed from legislative regulation to the after-the-fact regulation of the judge's subjective judgment and through a series of reforms to protect consumers in consumer loan contracts. This series of changes highlight a more liberal attitude towards borrowing rates. Therefore, the current regulation of private lending rates in the UK is similar to that of Germany, where judges determine whether high interest rates constitute high interest rates on the basis of the circumstances of the case. This model of interest rate regulation is a subjective legislative model, i.e., by law. In the case, the official subsequently established the interest rate ceiling of the loan contract on the basis of the circumstances, rather than the prior publication by the government or the law. This model is represented by Germany, and the UK and Germany are typical representatives of the subjective model. Foreign scholars believe that although there is no anti-usury law in the UK, due to marketization, in the constraints of supply and demand, it is difficult to form usury. Similarly, under the adequate supply of formal finance, network lending and formal finance form a competition, which decides that network lending is also difficult to have usury.C. An Analysis of the Practice and Legislation of the Interest Rate of Extraterritorial Network Lending1. Practice on Online Lending Rates. — The UK and the US are financial powerhouses of the world and two well-known countries for online lending, and their practice of interest rates has two things in common.Firstly, interest rates are calculated separately from the intermediary rate. The UK and the US online lending platforms clearly define the standard of charge for settlement-intermediary fees when they conduct their business. The cost of intermediary and interest rate was not harmonized into interest rates and included in the statutory limits. Secondly, the interest rate and intermediary rate are combined for information disclosure. Whether the UK or the US network lending platform, they all use comprehensive financing cost of borrowing as a unified standard which is published in their official websites, that is, is to combine the interest rate and inter-residential rate for public information disclosure, and will be separately clear inter-residential rate collection standards. The practice of the US and the UK shows that interest rates and interstitial rates are two separate costs in online lending. And these two costs, especially intermediary costs, require explicit disclosure.2. Legislative Provisions on the Interest Rate of Online Lending. — Firstly, the standard of interest rate legislation is different. The US and the UK adopt different standards in interest rate legislation. The US uses objective legislation standards, and many states will have special interest rate legislations, using caps to limit high-interest lending. The UK adopts subjective legislative criteria on interest rates, which do not specify specific criteria for interest rates, but only specific principles, which are treated specifically by judges. Secondly, interest rates do not include intermediary rates. There is no legislation or jurisprudence in the UK to limit the fees charged by intermediaries, only the restrictions on interest rates, which do not include intermediary rates. Thirdly, interest rates include the default payment component. From cases that adjudicated interest on loans includes default payments in the legislation of the US, default payments are part of the interest rate on borrowing.V. RECONSTRUCTING THE INTEREST RATE RESTRICTION SYSTEM OF CHINA'S NETWORK LENDING INDUSTRYThe stakeholder characteristics of network lending industry need legislation to unify interest rates, through transparent information release, giving borrowers and lenders better judgments. Thus, China's interest rate system of network lending industry needs to be reconstructed. A. The Independent Application of Interest Rate and Intermediary RateLegislation should clearly define the range of interest rate to ensure the transparency and uniformity of interest rate. The online lending market should be a transparent market, and it would be more appropriate for interest rate to be disclosed at a uniform standard.1. Intermediary Rates and Other Interstitial Rates Are Not Part of Interest Rates. — Firstly, the relativity of debt determines that the intermediary fee rate and interest rate cannot be unified. Network lending needs the existence of intermediaries, including network lending platforms,. The network lending industry needs at least two types of legal relationships. One is the legal relationship between the borrower and the lender of the loan contract. The other is the inter-contract relationship among the intermediary and the lender and the borrower. Represented by the network platform, the first type of contract paid cost is in the form of interest rate, and the second type of contract paid cost is in the form of interstitial rate. The two types of contracts are different from those who pay the price. If the interstitial rate is used as an interest rate component, although the interest rate standard of the network lending industry can be harmonized, the hidden interest rate will be reduced, and the interest rate ceiling should be avoided, which substantially reduce the borrower's comprehensive financing cost. However, legal terms cannot explain why the unified interest rate and intermediary rate will break the basic theory of the contract of the relativeness of debt. According to this theory, the interest rate can only be the consideration between the borrower and the lender, and should not be infinitely extended to the intermediary, that is, the non-contractual third person.Although the relativity of debt also has breakthroughs, such as non-break leases of sale and purchase, property right embodiment in creditor's rights. These breakthroughs are mainly based on security, efficiency or justice of debt considerations forneeds of legal practice and social development. However, the merger of the intermediary rate and interest rate mainly restricts the arbitrary charge of the interbank fee. The contract price will not affect the security and efficiency of the debt, for the justice of the debt may need to consider the charge of intermediary fee, but the relativeness of the debt is the basis of the debt law. The fundamental breakthrough must be a remedy that can only be used when the debt relief measures are exhausted and the problems still cannot be resolved. The norms of intermediary fees do not need to be protected by breaking the relative nature of debt. On April 25, 2019, Liu Guoqiang, Vice President of the People's Bank of China, at a regular briefing meeting on the State Council's policy pointed out that the People's Bank of China will work with the China Banking and Insurance Regulatory Commission, the Development and Reform Commission, the Ministry of Finance and other relevant departments to take strong measures to clean up and regulate the additional costs of enterprise mortgage registration, asset assessment, bridge crossing, etc. to substantially reduce the cost of integrated financing for small micro-enterprises. Thus, formal finance is also taking measures to promote the reduction of the cost of comprehensive financing for vulnerable groups represented by small and medium-sized enterprises, but the measures taken do not combine intermediate costs with interest. Nevertheless, only through the intermediate cost of the norms to reduce this cost, are regulatory measures of the regulatory authorities for regulation, which did not change the relativity of the contract and break through the principle of debt law for regulation. Similarly, the regulation of the cost of online lending can also be regulated and self-disciplined through regulation or industry self-regulation, without changing the legal rationale to adapt to development.Secondly, the independence of debt determines that intermediary fees and interest rates cannot be unified. The loan contract and the intermediary contract in the network lending behavior are two separate contracts in the fifteen categories of contracts specified in the Contract Law. There is no mastering between the loan and the intermediary behavior, and the independence of the two bonds determines that the two bonds should have an independent effect. Limiting the intermediary fee to interest would make the inter-contract theory of the contract as the contract of borrowing contract, and it is clear that such unification would bring legal confusion.Thirdly, the payment time determines that the interbank rate and interest rate cannot be unified. Inconsistency between the payment time of the intermediary fee and interest determines that the intermediary rate cannot be unified with the interest rate. The interest shown at the interest rate needs to be paid after the expiration of the contract and must not be deducted in advance from the principal, while the intermediary service fee needs to be paid when the transaction is facilitated. The typical sign of the network lending platform to facilitate the transaction is the facilitating of the loan transaction, that is, the loan transaction was facilitated at the time of the lender's loan, at which point there should be a cost of the intermediary. If the intermediary fee is included in the interest of the unified restriction, then the consequences should be that the cost of the intermediary fee should not be allowed to be paid in advance, which will make the network lending platform obtain the cost time pushed back and contrary to the intermediary fee in facilitating the transaction, affecting the normal operation of the network lending platform.

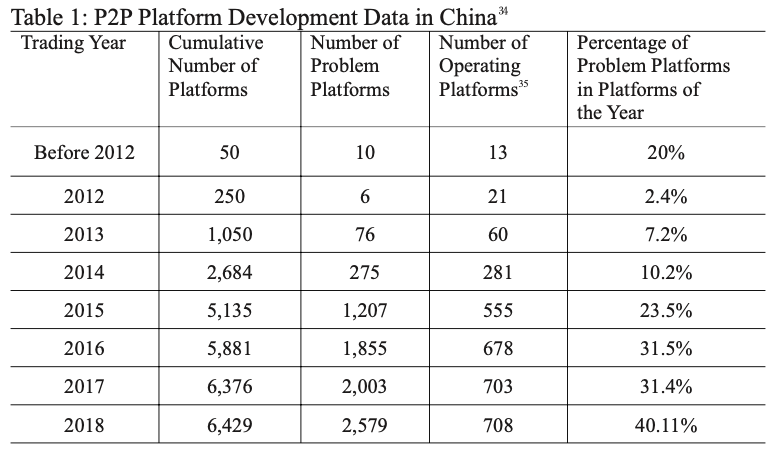

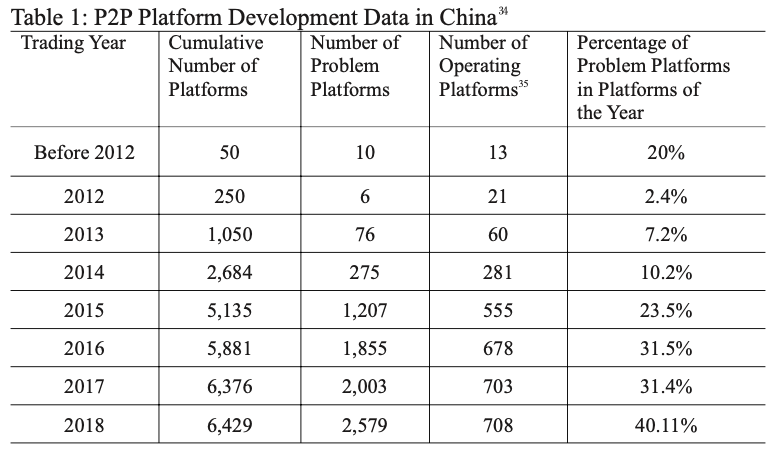

2. The Intermediary Fee Disguised to Break the Legal Interest Rate Ceiling Has No Living Space. — China's first online lending service platform was established in 2007. After the development period of China's private lending loan was suppressed, the market demand for new types of online lending increased. Because there is no regulatory supervision, the early network lending platform entered into a brutal development period. Many problems have also been raised, including the high fees for intermediary, but on August 24, 2016, the China Banking Regulatory Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, and the State Internet Information Office formulated the Interim Measures for the Management of Business Activities of Network Lending Information Intermediaries, and the network lending platform entered the regulatory period. The number of network lending platforms showed negative growth. According to the third-party information platform Home of Network Loan's data release, P2P platform development status quo is as follows.

From Table 1, these phenomena can be seen. Firstly, the network lending platform in China has been through rapid development. Secondly, at the same time, during the high-speed growth, there are many problem platforms. About 30 percent of the platforms have problems. The main problems of the platforms are running, closing, cash-out difficulties and investigation intervention. Thirdly, the platform survival rate is very low. Table 1 shows a sharp decline in the number of platforms in operation, with a platform survival rate of only 11 percent. Thus, the network lending platform after the brutal period of unsupervised development has entered a stable period of normative development, and from the number of survival platform, the number of survival platform is relatively stable after the supervision in 2016. After strict supervision of all parties' behaviors, these platforms will be more standardized. In the meantime, in order to meet the needs of market competition, the platform will charge more reasonable fees, so as to increase the size of the platform, thus improving the survival rate of the platform.

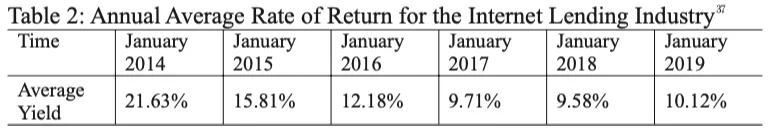

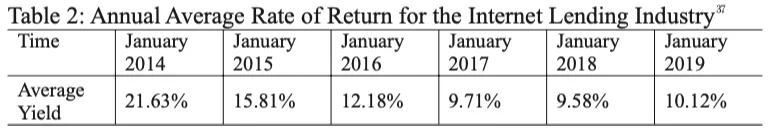

From Table 2, the average return on the online lending industry has declined significantly over the past six years, from 21.63 percent in 2014 to 10.12 percent in 2019, a decline of almost half. The decline in the annual average rate of return indicates that the financing cost of funds is decreasing, and shows that in recent years the state has taken a series of measures to increase financial investment efforts, and promote the reduction of financing costs to achieve effective results. It also shows that market competition in the network lending industry is increasing.

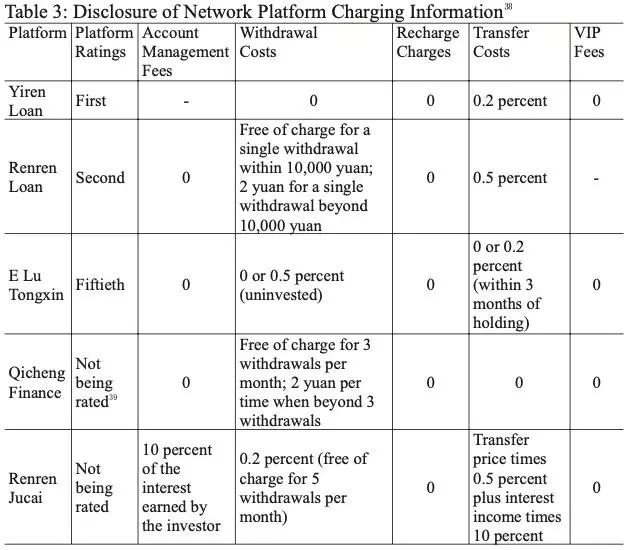

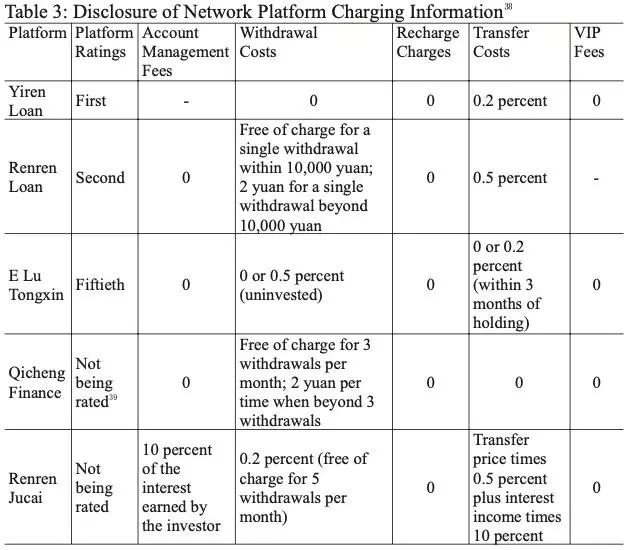

From Table 3, other item charge of the platforms is normative. The current network platforms, whether the better rating platforms or those that do not meet the rating requirements of the platform, the platform fees are reflected in the platform official website. Platform charging projects are basically similar, and the difference of the cost disclosure is little, and the fee charge is not very high, indicating that the platform's disorderly charging phenomenon has been improved. However, the platform's intermediary service fee is not reflected. It is opaque when the platform will charge borrowers to promote transactions with not publicly disclosed service fee.Tables 1, 2 and 3 show that the behavior of the network platform is constantly being regulated, and it is unlikely that the borrower's comprehensive financing cost exceeds the interest rate ceiling. Network lending industry can improve the problem of expensive financing, since the problem platforms are becoming less, and the behaviors of the platform will be more standardized, which will attract more funds into this emerging industry with more confidence.3. Changing the Platform's Information Disclosure Standards. — Network lending industry should first establish a unified information disclosure system for the comprehensive financing cost of borrowers. Interest and cost are essentially borne by the borrower, and the comprehensive cost of the borrower is mainly composed of these two parts. China's network lending platforms are using the average annual rate of return. The rate of return only refers to the borrower to pay the interest rate given to the borrower, which does not fully reflect the borrower's financing costs. The lender's income needs to have detailed information disclosure, at the same time, the cost of the intermediary not only affects the lender's income, but also affects the realization of the platform income. Although the interstitial fee is paid to the intermediary platform, but it is still related to the lender, and the intermediary fee is too high, which will increase the burden on the borrower, and increase the risk of default, affecting the lender's rights to realize. Therefore, the lending project should be the interest rate and the interbank rate after the merger of the unified financing cost rate disclosure, so that the borrower can fully understand the cost of the loan project, judge whether the loan rate is reasonable. It is also helpful to judge the strength of the borrower. For a good credit borrower or a good project, the integrated financing cost of borrowing provided by the borrower is certainly low, and if the comprehensive financing cost of a project is high or the intermediary cost is high, it may indicate that the project itself is not very good or that the intermediary platform may have a problem. Full unified information disclosure of financing cost can enable lenders to judge the reliability and feasibility of the project better. The same unified information disclosure includes interest rates and intermediary rate of platforms. In the case of a certain amount of capital costs about the same time, the cost of the intermediary will affect the unified financing costs, so that borrowers can choose the low-cost financing platform for financing. Based on the needs of market competition, the platform will reduce the intermediary rate, and ultimately realize the reduction of the cost of financing funds. In summary, the disclosure of project information on China's online lending platforms should disclose the borrower's comprehensive financing cost, that is, the combined disclosure of interest rate and interbank rate. When the comprehensive cost is disclosed on the network, the regulatory authority can also compare the intermediary rate of network information disclosure with the actual intermediary rate charged to the parties by the platform, analyze whether there is a hidden rate, promote the network lending platform to collect the intermediary fee transparently, and eliminate the hidden intermediary fee.The network lending industry should also establish a public disclosure system for intermediary fee collection standards. From the data of the thre tables above, it can be seen that the network lending platform generally does not disclose the platform's intermediary service fee. Intermediary service charge is one of the important financing costs of borrowers. The interstitial service fee should be reflected in the interstitial contract, but because of the borrower's weak position, there may be unreasonable price of the contract. And there may be hidden interstitial costs outside the contract. If the platform is required to publicly disclose the cost of residential services, the platform will be subject to the supervision of industry self-regulatory organizations and members, as well as the supervision of the regulatory authorities, and hidden charges and unreasonable charges will be difficult to survive.B. Merger Regulation of Interest Rates, Default Payments and Other Items1. The Borrower's Payment of the Fee Given to the Lender Can Be Paid in Combination. — Interest rate is the consideration of the use of funds, and the default is the breach of the default during the breach of compensation or punishment. Although the two functions are different, during the default lenders still have the right to charge the borrower the contract agreed interest, which will make the interest rate and default payment superimposed. According to the relevant provisions of the Contract Law, the breach of contract and other breaches of contract costs can be combined, because the interest rate is the price of the normal use of funds, and default costs including breach of contract is the penalty or compensation for breach of contract. The two are not in conflict in law. At the same time, the interest rate is the contract between the borrower and the lender in the loan contract agreed. The default payment is also required to be agreed in advance to use. Due to the shortage of funds, the lender in the loan contract increase the disguised increase in interest rates through high default and other default costs. Without limiting this, there would be a hidden high interest rate scenario. Therefore, in the judicial interpretation of the supreme people's court on private lending, combining default payment and other default costs agreed upon at the time of the conclusion of the contract into the range of interest rates for uniform restriction is reasonable, and the purpose is also justified.2. Fees Paid by Borrowers to Different Persons May Not Be Included in the Interest Rate Limit. — The comprehensive cost of online lending borrowers is reflected in the payment to different objects. Although the current attitude of the Supreme People's Court and other courts is to include all financing costs into the interest rate range for uniform restrictions, such restrictions will break through the relative nature of debt, resulting in payment time confusion. On the other hand, the reduction of the comprehensive cost of borrowers is also very necessary. P2P online loan platform is essential for small and medium-sized micro-enterprises and individuals to provide new financing channels. Its procedures are simple and flexible, which open the era of 'mass finance'. The borrower on the network lending is the tail part of the 'long tail theory', that is, the subject that is not served by the formal financial institutions, which changes the formal financial institutions to control the scarce resources of funds, serves the traditional financing difficult subject, and implements the concept of financial inclusion. At the same time, the network lending industry makes the public participate in the field of private lending, provides more capital providers, increases the source of funds, and changes the phenomenon of private lending capital. The fundamental reason that the new network lending industry can be effectively implemented is that it can change the phenomenon of financing difficulties and expensiveness. If the network lending industry increases interest rates by raising the hidden interest rate in disguise, this innovative industry may lose its value. Therefore, reducing the financing cost of borrowers is the real meaning of the network lending industry as a new industry with innovation, and also the main aspect that the regulatory authorities should supervise. However, the cost of comprehensive financing is not all unified into the interest rate, with the application of unified provisions of the private lending statutory interest rate ceiling, the unified limit of interest rates can only limit between lenders and borrowers, and the fees beyond the loan contract cannot apply the unified interest rate limit. The Office of the Comptroller of the Currency of the US considers that interest includes any compensation paid to creditors or future creditors as a result of deferred payments, including annual credit card fees, membership fees, deferred payments, etc., but excludes the fees paid to third-party for identification fees, notarization fees, insurance premiums, assessment fees and expenses incurred to obtain credit reports. This restriction is essentially on the borrower and the lender through the loan contract to advance the pre-set interest, fees, default, compensation and other expenses to the unified scope of interest rates, so that interest rates accept the legal limit. The interest rate range cannot include fees paid by the borrower to non-lenders, mainly because such fees are not the same contract as the loan contract and cannot be subject to merger restrictions. There is no precedent for extraterritorial countries to combine interest rates with intermediary fees, and only the practice of combining default costs with interest on borrowings is worth learning for China. At present, the judicial field has deviated too much from this principle, making the relative failure to comply with the debt, and causing confusion in payment. Legislation should correct this fault. It is helpful that the agreed expenses of the borrowing contract enter into the unified category of interest rates to carry out a unified norm, the intermediary fees and interest rates become independent, the market can adjust the intermediary fees, and the regulatory part and industry self-regulatory organizations can unify the regulation of the intermediary's fees' reasonableness and legitimacy. The norms of the network lending industry should not only reflect the autonomy of contracts, but also reflect the combination of industry norms and regulations, so as to make the legislation of this new industry more scientific and reasonable.C. The Combination of Market Adjustment and Industry Self-regulation to Regulate Emerging IndustriesNetwork lending platform is a typical business subject, and how to adapt to market competition should be known. In the standardized market environment, charging a too high intermediary fee will not attract more borrowers and lenders to enter the platform. If more borrowers are willing to enter the platform, the project provided is certainly not ideal borrowing projects. Such projects will bring high risk, which will affects the image of the platform, so that the platform cannot continue to operate in the market. From the platform development data of Table 1, platforms with only 11 percent survival rate will certainly pay more attention to market rating. A single platform will not charge more inter-service fees, compared with other platforms in the industry. In addition, the industry platform will charge a high service fee as a whole. From Table 2, in recent years, the yield of lenders is in a significant reduction, which shows that the shortage of funds in the market is relieved to a certain extent, and the loans provided whether by formal finance or other types of financial institutions like platforms are under the marketization of lending interest rates. The overall charge of the platform industry is bound to be related to the needs of the capital market, and it is almost impossible for the platform to charge a high fee as a whole.In addition to the market adjustment, industry self-discipline can also constrain the platform's standard charges. Network lending industry since 2016 has entered the management model with the combination of administrative supervision and industry self-discipline. Network lending platform in this management mode gradually enters into the standardized running track. Regulatory legislation should only be a principled provision, and the specific business rules of the industry should be formulated by the industry self-regulatory organizations and handed over to members to implement. For example, the P2PFA has four responsibilities, one of which is to develop and modify the operating standards and rules of the internet lending industry. And in June 2012, it established a regulatory network named the Operating Rules of P2P Industry. On March 25, 2016, the China Internet Finance Association was established by the State Council, which opened up the self-regulatory management model of the network lending industry. Under the dual management of industry supervision and self-regulation, the possibility of platform charges is also very small.Network lending itself is private lending, and the behavior of the parties will be spontaneous and irrational. Thus, the need for legal norms is necessary. The management of the network lending platform has been gradually standardized. The legislation should give the main business more relaxed environment, so that it is the survival of the fittest in free competition, coupled with industry regulation and self-discipline, then the industry can be more standardized, while the competition is orderly. That network lending industry belongs to the stakeholder industry has decided that lenders will lack the knowledge about lending. They will not pay attention to the specific composition of interest rates, and the cost of borrowers. They will only pay attention to their own high returns. The borrower's urgent need for funds resorts to the operation of the platform. The platform needs to protect the lender's income. Otherwise the platform cannot facilitate transactions. The platform also needs to protect its own high returns to achieve business objectives. The high return of the lender can be increased in disguise by means of fees agreed upon in the loan contract in addition to the interest on borrowings such as default payments. The platform can increase the fees and the proportion of fees charged in addition to the interest rate by setting up the form of the borrowing contract, which is in fact disguised as raising interest rates. Legislation should regulate such acts of covering up illegal purposes in a legal form, so as to guarantee the borrower's substantive fairness and reduce the cost of financing. The high return of the platform and the lender can also be achieved by charging a high cost of interstitial fees, at which time although the purpose of the platform behavior is not legitimate, but because the intermediary fees and interest cannot be attributed to the same contract, legislation cannot unify the two for regulation. The regulation of intermediary fees can only be regulated through competition in the market. At the same time, through the industry self-regulatory organization to restrain the fees between members, and through the establishment of a unified financing cost information disclosure system, the regulatory authorities can supervise through information disclosure, and eliminate the phenomenon of invisible collection of intermediary fees, so that the intermediary fee collection can be transparent and open to enable both borrowers and lenders to make full choices in a transparent information environment and to achieve contract fairness, justice and contractual autonomy.